Stepping Out of My Comfort Zone

Up until this year, the mention of a play date for Conor sent my blood pressure sky high and stress levels through the roof! I had tried so many times to organize them for him, and pretty much every one ended in disaster. You know what I mean – you apologize to the other parent, you feel terrible because the other child has not had a good time, and after all that you still have to deal with a very escalated child because the whole experience has been too overwhelming for them.

Up until this year, the mention of a play date for Conor sent my blood pressure sky high and stress levels through the roof! I had tried so many times to organize them for him, and pretty much every one ended in disaster. You know what I mean – you apologize to the other parent, you feel terrible because the other child has not had a good time, and after all that you still have to deal with a very escalated child because the whole experience has been too overwhelming for them. We planned snacks and what to do when he was in the ‘yellow zone’. Conor had set up a quiet corner, so he knew that would be a good place to go to for a break. When movement breaks were needed, he came up with the options of playing outside, playing a Wii sports game, or using his sensory equipment. Lastly, we practiced saying goodbye when the time came. I made sure that I had extra support because I knew that this would be essential for both of us!

We planned snacks and what to do when he was in the ‘yellow zone’. Conor had set up a quiet corner, so he knew that would be a good place to go to for a break. When movement breaks were needed, he came up with the options of playing outside, playing a Wii sports game, or using his sensory equipment. Lastly, we practiced saying goodbye when the time came. I made sure that I had extra support because I knew that this would be essential for both of us!

Jeff’s Marathon for Autism

One of the greatest things about having a child diagnosed with autism is the way it enriches our lives. Autism pushes us off what we thought would be a comfortable, familiar path into a new world. Because we want the very best for our kids with autism we steadfastly face situations we’d rather not have to deal with. We challenge ourselves to stretch our capacity to create a better world, so our kids can have the best futures possible. In stretching ourselves for our kids, we find ourselves growing in ways we had never imagined.

One of the greatest things about having a child diagnosed with autism is the way it enriches our lives. Autism pushes us off what we thought would be a comfortable, familiar path into a new world. Because we want the very best for our kids with autism we steadfastly face situations we’d rather not have to deal with. We challenge ourselves to stretch our capacity to create a better world, so our kids can have the best futures possible. In stretching ourselves for our kids, we find ourselves growing in ways we had never imagined. Jeff was lucky. His application was selected for the New York City Marathon on November 6, 2016. Jeff’s marathon run will raise funds for the Fort McMurray Autism Support Group, which operates under the auspices of Autism Alberta.

Jeff was lucky. His application was selected for the New York City Marathon on November 6, 2016. Jeff’s marathon run will raise funds for the Fort McMurray Autism Support Group, which operates under the auspices of Autism Alberta.There’s no doubt about it. Autism changes things. People like Jeff Bowers show how much we can grow and what we can do because we love someone with autism.

March Updates from FMASG

Kirsti Mardell

On March 13th, Fort McMurray Autism Support Group had a Family Fun Day out at Tour North Ranch. There were two full hay rides with a big fire. Kids got to roast hot dogs and marshmallows. The kids and some adults went sledding down the big hill Tour North Ranch has, and finished it off with some hot chocolate. It was a beautiful day for our families to get together and enjoy.

Fort McMurray Autism Support Group would also like to thank the Kinette Club of Fort McMurray. On February 16th, the Kinette Club of Fort McMurray hosted a Charity Swim Day. The community was invited down to MacDonald Island Park to go swimming for a donation. On March 16th the Kinette Club also hosted a pot luck dinner and presented a donation check to the Fort McMurray Autism Support Group. Thanks to the Kinette Club for their support!

On March 25th, Fort McMurray Autism Support group, supported by Dunvegan Gardens, will be hosting our first Easter Egg Hunt. Children with special needs and children under 2 years old are free to come; for all other siblings it will be a $5 fee for a ticket to participate. Participants are responsible for bringing their own Easter Basket. Event will start at 2pm down at Dunvegan Gardens. This is a private event put on by the Fort McMurray Autism Support Group, for more info please contact the Fort McMurray Autism Support Group.

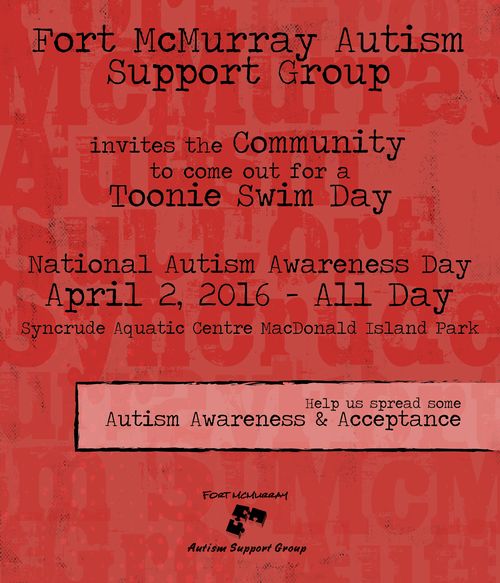

April 2nd is National Autism Awareness day. Fort McMurray Autism Support Group will be hosting a Toonie Swim Day All Day at MacDonald Island park. The community is invited to come out and support the 3 A’s: Autism, Awareness and Acceptance. There will be a table with info on autism and our Facebook Group. We will also have our Kid’s First Camp Water bottles for sale as well as Autism Pins and Lanyards.

On April 9th at 2pm Fort McMurray Autism Support Group will be hosting a Press Conference at McDonald Island Park in the main concourse to say “Thank You” to our community supporters. The event will feature guest speaker Jessica Pigeau of Edmonton Alberta, an adult with autism. There will be plaques to handed out, and everyone who has supported us over the last five years will be invited to attend.

Bubbles for Autism in Red Deer

Blowing bubbles for ACCEPTANCE & AWARENESS

Please come on out to Parkland Class Accessibility playground and join us in recognizing Autism awareness by blowing bubbles and celebrating the amazing diversity in our community. Don’t forget to wear BLUE!

Parkland School Accessibility Playground

6016 – 45 Ave Red Deer

Bubbles Provided! Free Refreshments!

Taking Care of Ourselves

I have worked for a number of years as a researcher in autism issues. One problem that troubles me is the challenge of what is known in the literature and how that research gets translated into solutions that help people in real life. In particular, the research on stress for the primary caregivers specific to autism is concerning. If you are happy, healthy (mentally and physically) and feel little stress then you likely do not need to read this article, but if you are struggling for a number of reasons, please read on.

Being a caregiver for a child or adult with ASD can be hard. Of course there are positive aspects of caregiving, but there are also lots of challenges. I was asked a few years ago by an autism agency, ‘What can we tell parents that will make them take care of their own health, too?’

Being a caregiver for a child or adult with ASD can be hard. Of course there are positive aspects of caregiving, but there are also lots of challenges. I was asked a few years ago by an autism agency, ‘What can we tell parents that will make them take care of their own health, too?’-

Financial Impact: Financial consequences of lifelong caregiving are higher than for other families. Three main reasons for this are: lost income of the primary caregiver, lost income of the adolescent/adult with ASD due to poor employment outcomes, and added out-of-pocket expenses.

-

Increased Chronic Stress: Lifelong chronic stress can impact mental health and physical health. Chronic stress can result in depression and anxiety. Chronic stress can also shorten telomeres (the ends of the chromosomes) that contribute to increased illness and aging.

-

Lack of time: Due to the increased supports beyond those needed by ‘normal’ children, many of us have less time for ourselves to participate in work, recreation or social events in comparison to other parents.

- Start the Registered Disability Savings Plan if you have not already. Small amounts contributed early on, with compound interest, can add up to a significant amount of money

- Consider your work situation. Explore opportunities to work flexible work hours with employers who understand flexible needs, work from home (if that seems appealing), change your profession, upgrade skills, start your own business, or continue to work to full time in a demanding career if you can find and/or pay for the added help you may need.

- Capitalize on all tax credits and benefits available to you.

Right now ask yourself, what am I doing well that I should be proud of, and what can I do today to take care of myself (even if it is just a deep breath)? We must be active from the start and all through our lives to pay attention to our own needs. Do not put your happiness and health at the bottom of the list, but at least at the same level as everyone else in your family.

Medical Sensory Series Helps Families Take Kids to the Doctor and Dentist

Deborah Barrett and Lauren McGuinness

Autism Edmonton, in partnership with Children’s Autism Service of Edmonton, wanted to help families and kids on the spectrum have better experiences. They realized that most children on the spectrum have many sensory issues that make going to the doctor or the dentist particularly scary and anxiety-producing for kids. So, they offered the Medical Sensory Series to help families deal with going to the doctor and going to the dentist. Here’s what they did:

Autism Edmonton, in partnership with Children’s Autism Service of Edmonton, wanted to help families and kids on the spectrum have better experiences. They realized that most children on the spectrum have many sensory issues that make going to the doctor or the dentist particularly scary and anxiety-producing for kids. So, they offered the Medical Sensory Series to help families deal with going to the doctor and going to the dentist. Here’s what they did: One little girl had a traumatizing experience with the weigh scale at a previous visit to the doctor years ago. In her second Happy visit she was enjoying the play and fun that was being had in the examination room, and before they all knew it she was standing on the scale! Her mother couldn’t believe it, and told us how they had to weigh her while her mother held her for the last several years. Her fear had been transformed into a sense of being able to cope with the new room and it was clear that new, positive associations had been made in this space.

One little girl had a traumatizing experience with the weigh scale at a previous visit to the doctor years ago. In her second Happy visit she was enjoying the play and fun that was being had in the examination room, and before they all knew it she was standing on the scale! Her mother couldn’t believe it, and told us how they had to weigh her while her mother held her for the last several years. Her fear had been transformed into a sense of being able to cope with the new room and it was clear that new, positive associations had been made in this space.Exciting New Services for Adults with ASD in the Edmonton Area

Following the recommendations of the report, with additional support from the Sinneave Family Foundation, and a partnership between GRH, Edmonton Oliver PCN, Alberta Health Services Addictions and Mental Health, a demonstration project was initiated.

Following the recommendations of the report, with additional support from the Sinneave Family Foundation, and a partnership between GRH, Edmonton Oliver PCN, Alberta Health Services Addictions and Mental Health, a demonstration project was initiated.For further information about or referrals to the diagnostic or consultation service please contact Elizabeth Kelly at the Glenrose (780-735-8852). For further information about or referrals to the primary care service please contact Alayna Burnstad at the Edmonton Oliver PCN (780-756-3434 ext, 227).

Director, Pediatric Rehabilitation

Keith J. Goulden MD, FRCPC, Dipl PH

Neurodevelopmental Pediatrics

Teaching Associate Professor of Pediatrics, University of Alberta

Fail-Proof

She’s always been like this – which is incredibly lucky for me because since the arrival of her little brother, I’ve needed an extra set of eyes to help with the basic day-to-day moments life throws our way. I remember one morning about four years ago I was trying to get ready for work when I heard the big kid yelling at me over the sound of the hair dryer. I went flying into the kitchen to find a one-year-old Captain sitting on top of the counter, pouring hot coffee onto his sister. Her eyes were wet with tears, but her arms were up and she would not leave his side. After simultaneously grabbing the coffee pot from the baby, placing the baby on my hip and pushing my little girl away from the hot contents on the counter, I spun on my heel to see if she was okay.

She’s always been like this – which is incredibly lucky for me because since the arrival of her little brother, I’ve needed an extra set of eyes to help with the basic day-to-day moments life throws our way. I remember one morning about four years ago I was trying to get ready for work when I heard the big kid yelling at me over the sound of the hair dryer. I went flying into the kitchen to find a one-year-old Captain sitting on top of the counter, pouring hot coffee onto his sister. Her eyes were wet with tears, but her arms were up and she would not leave his side. After simultaneously grabbing the coffee pot from the baby, placing the baby on my hip and pushing my little girl away from the hot contents on the counter, I spun on my heel to see if she was okay.

Princess P had never mentioned anything about a kid in her class having a physical disability. When I quizzed her on it after school I was shocked to discover the student was one of her best friends – a kid I heard about a million times – but never, ever, did I hear about a wheel chair. When I asked her why she hadn’t mentioned it, she just shrugged her shoulders with that you’re-boring-me-mom sentiment shared by all children her age. It was her passive/productive way of reminding me it was a non-issue.

I thank my lucky stars for having the opportunity to be her student.

We Want to Hear From You!

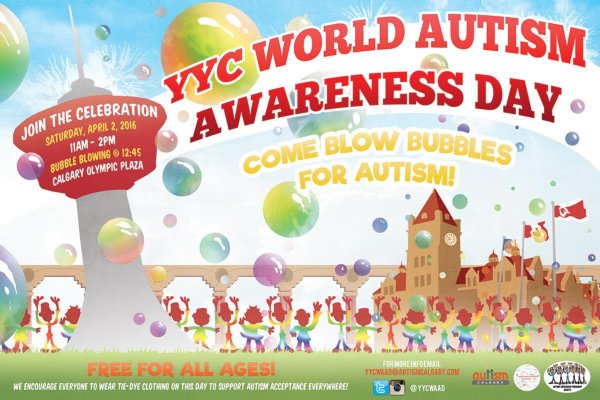

Autism Calgary Celebrates Autism Awareness Day

Click the poster to see a larger version

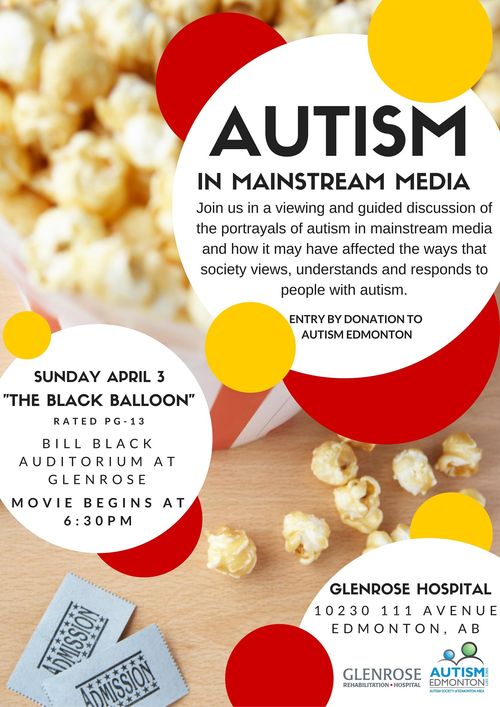

Special Presentation: Autism in Mainstream Media

Click the poster to see a larger version

Join us on Sunday, April 3, for a special viewing of “The Black Balloon” that will include a guided discussion about the portrayals of autism in mainstream media, and how they might affect the ways that society views, understands and responds to people with autism.

The viewing will be held at the Bill Black Auditorium at the Glenrose Hospital (10230 111 Ave, Edmonton, AB).

Hope to see you there!

Autism Canada Builds Its Nationwide Network

Autism Canada is thrilled to be celebrating 40 years of hope advocacy and support. While we are proud of what we have accomplished, there is still much work to be done. We are focused on bringing ASD adults together to share and grow, to advocate at the federal level and to continue fulfilling our role as a national knowledge hub providing current and timely information to the ASD community.

Our ASD Advisory Committee has several exciting projects in the works. ASD Central, Canada’s Facebook Forum for Adults on the Spectrum, is a place of conversation, sharing and mentoring. This group is the only one of its kind in Canada, and we couldn’t be more proud of all the participants who make it possible. On the west coast, this same ASD Advisory Committee is involved in an adult-focused conference taking place on April 1st in Terrace, BC. Autism Canada is proud to be involved in recording the presentations for future viewing by the ASD community. In Ontario, we will be co-hosting an ASD adult conference in August of this year. The focus of this one-day event is brining ASD adults together to learn and share amongst their peers in a space that is comfortable, accommodating and autism-friendly. We will be happy to share more details as they are confirmed.

Our ASD Advisory Committee has several exciting projects in the works. ASD Central, Canada’s Facebook Forum for Adults on the Spectrum, is a place of conversation, sharing and mentoring. This group is the only one of its kind in Canada, and we couldn’t be more proud of all the participants who make it possible. On the west coast, this same ASD Advisory Committee is involved in an adult-focused conference taking place on April 1st in Terrace, BC. Autism Canada is proud to be involved in recording the presentations for future viewing by the ASD community. In Ontario, we will be co-hosting an ASD adult conference in August of this year. The focus of this one-day event is brining ASD adults together to learn and share amongst their peers in a space that is comfortable, accommodating and autism-friendly. We will be happy to share more details as they are confirmed.As we head further into this year, we are continuing to bring forth valuable and relevant information to families and individuals on theautism spectrum. In September of this year, we will be co-hosting a conference with our Provincial and Territorial Council member, Autism Nova Scotia. We are excited about the lineup of topics and the speakers who will be presenting them. Families, individuals, health professionals, educators and friends will all gain from attending this 2-day conference. For more information about this event, please be sure to check in with our social media or our website www.autismcanada.org.

Autism Physician Handbook

Autism Canada is proud to present a Canadian Edition of the Autism Physician Handbook. We would like to thank Linda Lee from the Help Autism Now Society, who is the original designer and developer of this document and has allowed us to revise it for Canadians. The fully illustrated Physician Handbook, with over 100 illustrations showing the common characteristics of autism in toddlers, comes complete with the M-CHAT-R Checklist, a visual guide to behavioural symptoms, summary of potential referrals, and tips for optimizing office visits.

Autism Canada is proud to present a Canadian Edition of the Autism Physician Handbook. We would like to thank Linda Lee from the Help Autism Now Society, who is the original designer and developer of this document and has allowed us to revise it for Canadians. The fully illustrated Physician Handbook, with over 100 illustrations showing the common characteristics of autism in toddlers, comes complete with the M-CHAT-R Checklist, a visual guide to behavioural symptoms, summary of potential referrals, and tips for optimizing office visits.“The thought of diagnosing a child with autism can be daunting to physicians. This book – filled with clever illustrations and easy explanations – is a great tool for physicians and other care givers trying to deal with this issue. Thank you to the Help Autism Now Society and Autism Canada for putting together a very helpful resource that can easily be used by anyone involved in the early detection of autism.”

Dr. Wendy Edwards, Pediatrician

Chatham, ON

Click here to read it

Want to Reduce Your Taxes?

To qualify for the Disability Tax Credit, you have to fill out form T2201, Disability Tax Credit Certificate, and have it approved by the Canada Revenue Agency (CRA). You can click here to see if you may qualify for the Disability Tax Credit. To find out more about the Disability Tax Credit, click here.